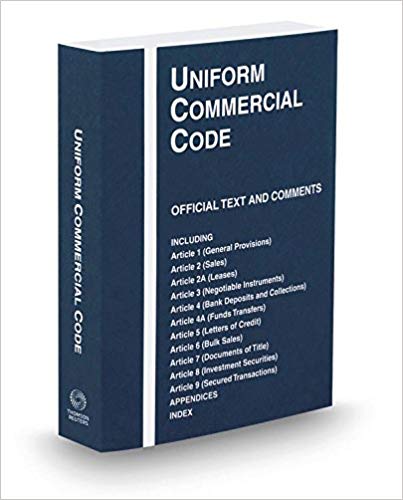

What is a UCC Filing?

In the complex landscape of business financing, understanding key concepts such as UCC filings and personal guarantees is crucial for entrepreneurs seeking funding. Let’s delve into these terms and demystify their significance.

UCC Filings: A Vehicle for Financial Security

Comparable to a finance company holding the first lien on a vehicle title, UCC filings play a pivotal role in securing financial agreements. Picture this: when you finance a car, the finance company maintains the first lien position on the title until the loan is fully repaid. In the business world, a UCC filing is initiated by the factoring company on your business’s accounts receivables. This filing serves as a legal mechanism, solidifying their ability to purchase your accounts receivables by treating them as collateral.

A Practical Example: The Dealership Analogy

To illustrate, consider the scenario where a dealership owner doesn’t receive the vehicle title free and clear until the loan balance is settled. The UCC operates similarly; it ensures that the factoring company has a legal claim on your accounts receivables until the agreed-upon obligations are fulfilled.

Personal Guaranty: A Safeguard for Lenders

Much like traditional financial institutions such as BofA or Wells Fargo, any factoring company or bank providing financing will request a personal guaranty. This crucial component protects the lender’s interests. As a business owner, I, too, have a UCC filed on both my personal assets and my business’s accounts receivables. This precautionary measure prevents me from starting a new venture without fulfilling obligations to my previous lender.

Duration and Evergreen Clause: Navigating the Financing Landscape

UCC filings typically have a duration of five years and are subject to an Evergreen Clause in most factoring agreements. This clause allows for automatic renewal unless proper notice to terminate is provided. The Evergreen Clause ensures the ongoing legal collateralization of the factoring company on your accounts receivables.

Considerations for a Seamless Financing Experience

In the event of existing UCC filings on your record, it’s vital to be aware that OperFi, or any similar entity, cannot legally purchase your accounts receivables until those filings are terminated. Being cognizant of existing UCCs is crucial to prevent delays in your financing arrangements.

Summary

Comprehending the intricacies of UCC filings and personal guarantees is integral to fostering a transparent and successful financial partnership. If you have any questions or concerns regarding these concepts, feel free to reach out. Your understanding empowers you to navigate the financing landscape with confidence.