In the ever-dynamic world of transportation and logistics, “factor” often gets treated like a dirty word. However, for those of us in the factoring business, the real “F-word” is “Fraud.” From fake invoices and bogus rate confirmations to counterfeit bills of ladings (BOLs), emails, phone numbers, and even bank statements, we’ve seen it all. Our battle against deception is relentless and constantly evolving.

Experiencing fraud as a factoring company is almost a rite of passage. We share stories about fraud together and learn from one another. Factoring companies may be a competitive group but one commonality among all is that we don’t want scammers to get the better of ourselves, our customers, or the industry as a whole.

Here’s How This New Fraud Works:

Protecting What’s Ours – Advice for Carriers, Brokers, and Factors

To further safeguard our industry, specific advice for carriers, brokers, and factors includes:

- For Carriers:

- Check Your Info: Regularly log in to your FMCSA profile to check whether your contact information has been altered without your knowledge.

- Insurance Verification: Contact your insurance agent to confirm that no unauthorized trucks have been added to your policy.

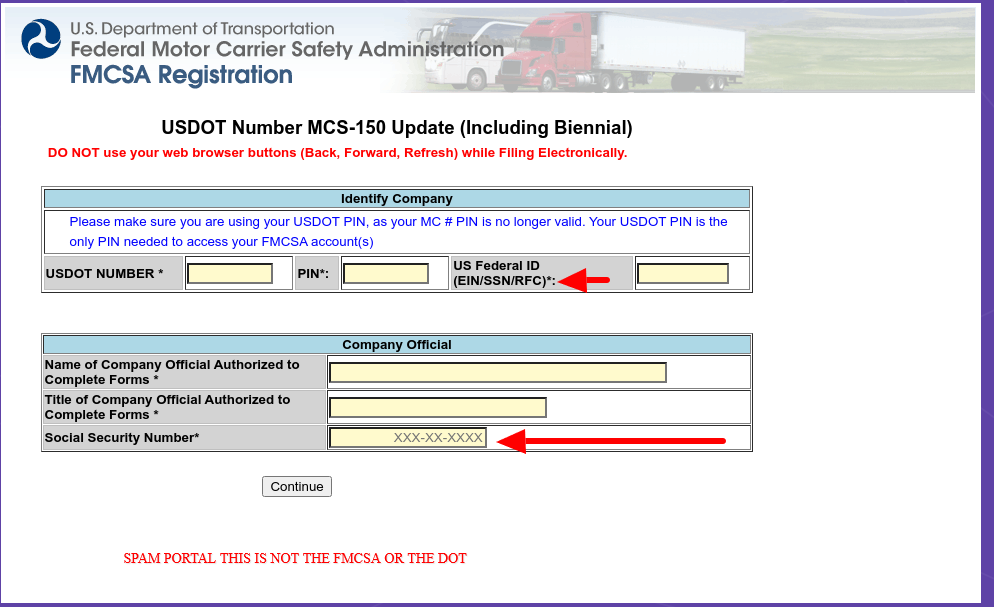

- Beware of Phishing: Be vigilant about emails that direct you to login pages that seem legitimate but might be fraudulent. Always confirm that the URL ends in .gov and avoid clicking on suspicious links.

- Factoring Partners: Partner with the experts. Factors have been there, done that, and seen it all. Your factoring partners should be monitoring double brokering and current trends in fraud. In this environment, your factoring partners should be subscribing to all the resources and be answering your questions on how to protect your business.

- For Brokers:

- Use Trusted Carriers: Always opt for carriers you know and trust. Preferred Carrier Networks are your most valuable asset during these times and also help to provide your customers with confidence and a sense of dependability.

- KYC Practices: Know Your Customer and Know Your Carrier. Request pictures of trucks, placards, and drivers’ licenses. Video calls can also help verify identities. Any pushback to any of these requests should signal a red flag.

- Carrier Vetting Services: Utilize services like Carrier411, Highway, Carrier Assure and CarrierOk to track changes in carrier information, such as MCS-150 updates. Carrierok.com provides dates when phone numbers and email addresses have been changed. Make this MCS-150 date change check a part of your onboarding checklist.

- Factoring Partners: Partner with the experts. Factors see fraud weekly, if not, daily. Find partners in the industry who are like minded and have a vested interest in protecting your company and your customer’s freight from scammers.

- For Factors:

- Too Good To Be True: Always question deals that seem too perfect, especially from carriers who have not needed factoring services for years but suddenly show interest.

- Domain and IP Checks: Verify the age of email domains for the customers and check the IP addresses used for signing contracts to see if a VPN is being used. With today’s technologies, it’s easy to determine if the business owner is actually located in their respective state when they’re signing up.

- Visual Confirmation: Ask for video calls and pictures of individuals holding their IDs to confirm identities. Many fraudsters will argue this isn’t possible or they can’t get on a Zoom call, which should be an immediate red flag. See our below example of what was submitted to us.

ACTUAL PHOTO OF A SCAMMER’S FAILED ATTEMPT TO PROVE TO US THEY ARE REAL BY PHOTOSHOPPING AN IMAGE OF THEM HOLDING THEIR ID.

As we navigate these challenging times, we must remain vigilant in protecting our businesses. Just as Ronald Reagan famously said during the Cold War, “Trust but verify.” That approach remains critical. While the FMCSA has stepped up with a task force and new measures, we in the industry must do our part too.

Whether you are a factoring company, freight broker, or carrier, the importance of diligence cannot be overstated. By implementing robust verification processes and staying alert to the signs of fraud, we can protect our businesses and maintain the integrity of the transportation and logistics industry. Let’s remain vigilant, train our teams, and keep a healthy level of skepticism. Together, we can overcome the challenges posed by fraudsters.